24+ Paying extra on mortgage

Amortization extra payment example. Making one extra payment each year.

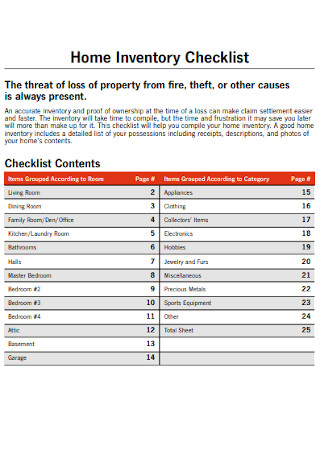

24 Sample Home Inventory Checklists In Pdf Ms Word

Heres a quick example.

. How Much Interest Can You Save By Increasing Your Mortgage Payment. To be more precise itd shave nearly 12. I pay taxes on that.

You can reduce your private mortgage insurance PMI. If you can up your payments by 250 the. In other words you make one extra full payment per year and you wont even feel it because youve budgeted for it.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Paying an extra 100 a month on a 225000 fixed-rate loan with a 30-year term at an interest rate of 3875 and a down payment of 20 could save. Paying Extra On Your Mortgage Paying extra on your mortgage means that you make additional payments to your principal loan balance beyond your regular payments.

Next 100 I keep 3 and pay 97. Its important to distinguish here that we are talking about. If I earn that 100 and buy a bond.

If you were shopping last year when mortgage rates were around 3 youd be looking at monthly principal and interest not including insurance or taxes of about 1350. If you made a down payment of less than 20 of the purchase. Paying extra on your mortgage loan may have other advantages.

Paying an extra 1000 per month would save a homeowner a staggering 320000 in interest and nearly cut the mortgage term in half. You can knock 5 years off your mortgage by paying an extra 200 per month or 10 years with an extra 400. I pay down my mortgage faster and save 3 in the future.

Adding Extra Each Month Just paying an additional 100 per month towards the principal of the mortgage. On the flip side lets see how making extra payments on top of your monthly. Assuming youve got a 100000 loan amount set at 4 on a 30-year fixed mortgage that extra 10 payment would save you 319181 over the full loan term.

I make the deduction and pay taxes on 3. For example a one-time additional payment of 1000 towards a 200000 30-year loan at 5 interest can pay off the loan four months earlier saving 3420 in interest. If the rate were 45 wed pay almost 100000 dollars more.

How many years can I reduce my mortgage by paying extra. 325 is a great low rate so you are probably better off investing elsewhere. There are a few ways you can pay extra on your mortgage.

If you can make 13 payments instead of 12. If you borrow 240000 at 4 for 30 years your minimum payment is 114580 and youll pay a total of 412486 for the loan. If you pay an extra 100.

Just paying an extra 50 per month will shave 2 years and 7 months off the loan and will save you over 12000 in the long run.

24 Commercial Brochure Designs Templates Psd Ai Free Premium Templates

How To Prepare Amortization Schedule In Excel With Pictures

13 Amazing Amortization Schedule Templates In Excel Find Word Templates

What Is Financial Literacy Advance America

How To Prepare Amortization Schedule In Excel With Pictures

Holiday And Christmas Loans Advance America

How To Get Out Of Debt Pay Off Debt Or Save Advance America

Refinance A Loan Advance America

Chris Menard Cmenardvpbmo Twitter

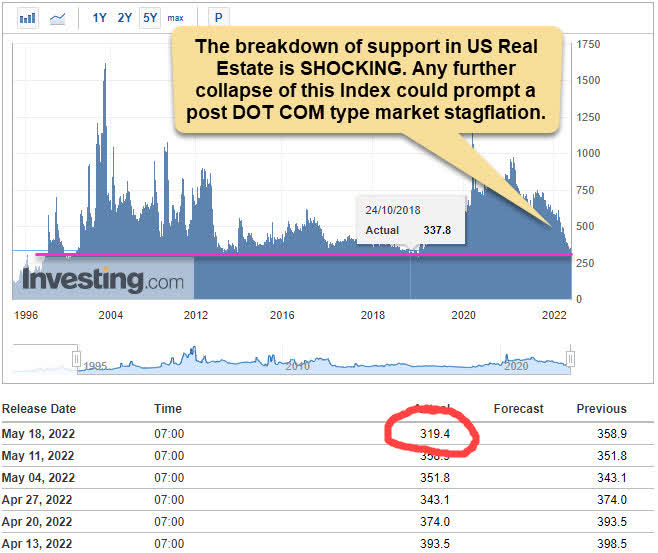

Real Estate Investors Is There An End In Sight Seeking Alpha

Debt To Income Ratio Advance America

The Appealing Download Customer Needs Analysis Style 10 Template For Free In Credit Analysis Report Template Pictur Analysis Cash Management Financial Analysis

Imagenes Gratis Dinero Economia Dolar Dollar Dolares Mucho Muchos Money Tattoo Emergency Fund Money

Conditional Deed Of Sale Of Motor Vehicle Word Motor Car Sell Car Car Purchase

5 Things You Should Know About Personal Finance

Chris Menard Cmenardvpbmo Twitter

David Lehnerd Senior Loan Officer Suntrust Mortgage Linkedin